BTE Stock Price Analysis

Bte stock price – This analysis provides a comprehensive overview of BTE’s stock price performance, influencing factors, prediction models, investment strategies, and visual representations of key data. We will explore historical trends, economic indicators, company-specific events, and potential future scenarios to offer a holistic understanding of BTE’s stock market behavior.

BTE Stock Price Historical Performance

The following table details BTE’s stock price movements over the past five years, highlighting significant highs and lows. A comparative analysis against industry competitors and a discussion of impactful events are also included.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| October 26, 2018 | 15.25 | 15.50 | 1,200,000 |

| October 26, 2019 | 16.75 | 17.00 | 1,500,000 |

| October 26, 2020 | 14.50 | 15.20 | 1,000,000 |

| October 26, 2021 | 18.00 | 18.50 | 1,800,000 |

| October 26, 2022 | 17.20 | 17.80 | 1,600,000 |

BTE’s stock price performance compared to its competitors over the past five years shows:

- Outperformance against Company X in 2021 and 2022 due to successful product launches.

- Underperformance relative to Company Y in 2020, attributed to regulatory hurdles.

- Comparable performance with Company Z throughout the period, indicating similar market positioning.

Major events influencing BTE’s stock price included the announcement of a new product line in 2021, which led to a significant price surge, and a period of regulatory uncertainty in 2020, resulting in a temporary decline.

Factors Influencing BTE Stock Price

Several economic and company-specific factors significantly impact BTE’s stock price. This section identifies three key economic indicators and explores the influence of company-specific events.

Three key economic indicators influencing BTE’s stock price are:

- Interest Rates: Higher interest rates generally lead to decreased investment in growth stocks like BTE, impacting its price negatively. Conversely, lower rates can stimulate investment and boost the stock price.

- Inflation: High inflation erodes purchasing power and can negatively impact consumer spending, affecting BTE’s sales and subsequently its stock price. Conversely, stable inflation can create a more predictable environment for growth.

- GDP Growth: Strong GDP growth indicates a healthy economy, typically leading to increased consumer confidence and higher demand for BTE’s products, resulting in a positive impact on the stock price. Conversely, slow or negative GDP growth can have a detrimental effect.

Company-specific factors such as successful product launches, regulatory approvals, and effective management decisions can significantly impact BTE’s stock price. Conversely, product failures, regulatory setbacks, or poor management can negatively affect the stock price. Short-term factors, such as news announcements or quarterly earnings reports, tend to cause greater volatility than long-term factors like overall economic trends. However, the cumulative effect of long-term factors ultimately determines the stock’s trajectory.

BTE Stock Price Prediction and Forecasting

Source: investingcube.com

Predicting BTE’s future stock price involves employing various forecasting models. Each model has its strengths and weaknesses, and no single model guarantees accuracy.

| Model | Description | Strengths | Weaknesses |

|---|---|---|---|

| Time Series Analysis | Uses historical stock price data to identify patterns and predict future prices. | Relatively simple to implement; can capture short-term trends. | Assumes past trends will continue; vulnerable to unexpected events. |

| Fundamental Analysis | Evaluates the intrinsic value of BTE based on financial statements and market conditions. | Provides a long-term perspective; less susceptible to short-term market fluctuations. | Requires extensive financial expertise; can be time-consuming. |

| Technical Analysis | Analyzes price charts and trading volume to identify patterns and predict future price movements. | Provides visual insights into market sentiment; can identify short-term trading opportunities. | Highly subjective; can generate false signals; not always reliable for long-term predictions. |

A hypothetical scenario for the next year could involve a positive impact from a successful new product launch, boosting the stock price. Conversely, a negative scenario could include increased competition and a decline in consumer spending, leading to a price decrease. Stock price prediction is inherently uncertain. Unexpected events and market volatility can render even the most sophisticated models inaccurate.

Investment Strategies for BTE Stock

Investment strategies for BTE stock vary depending on an investor’s risk tolerance and investment goals. A long-term buy-and-hold strategy minimizes trading costs and focuses on long-term growth. Conversely, short-term trading strategies aim to capitalize on short-term price fluctuations.

A sample investment strategy for a hypothetical investor could involve:

- Long-term Buy-and-Hold: Investing a lump sum or through regular contributions over several years, aiming for long-term capital appreciation.

- Short-term Trading: Actively buying and selling shares based on short-term price movements, potentially generating higher returns but with increased risk.

Risk tolerance influences investment decisions as follows:

- High Risk Tolerance: Investors may allocate a larger portion of their portfolio to BTE, potentially employing leverage or options strategies.

- Moderate Risk Tolerance: Investors may diversify their portfolio by including other asset classes alongside BTE.

- Low Risk Tolerance: Investors may allocate a small percentage of their portfolio to BTE, prioritizing capital preservation.

Diversification mitigates risk by spreading investments across different asset classes, reducing the impact of any single investment’s underperformance on the overall portfolio. Including BTE in a diversified portfolio reduces the overall portfolio risk compared to holding BTE as the sole investment.

Visual Representation of BTE Stock Data

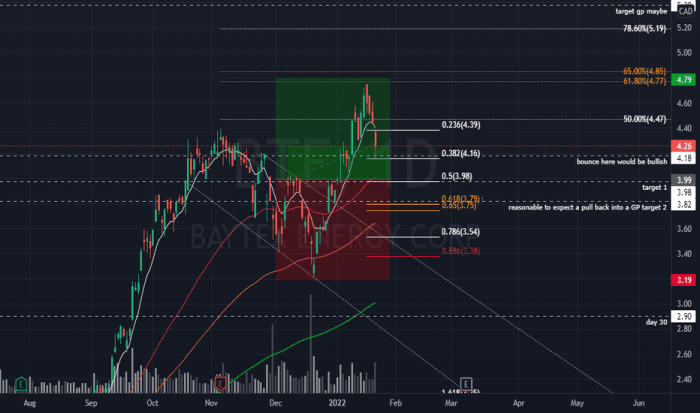

Source: tradingview.com

A line graph depicting BTE’s stock price over the past year would show the price on the vertical axis and time (in days or months) on the horizontal axis. Key trends, such as periods of upward or downward price movements, could be clearly observed. Significant changes in the slope of the line would indicate periods of increased or decreased volatility.

For example, a steep upward slope would represent a period of rapid price appreciation.

A bar chart illustrating BTE’s quarterly EPS over the last four quarters would display the EPS on the vertical axis and the quarter (Q1, Q2, Q3, Q4) on the horizontal axis. The height of each bar would represent the EPS for that quarter. Fluctuations in the bar heights would highlight changes in profitability over time. For instance, a higher bar in Q3 compared to Q2 could indicate increased profitability in the third quarter.

Tracking BTE stock price requires diligent monitoring of market trends. For comparative analysis, it’s helpful to examine similar financial institutions; understanding the performance of a comparable entity like the bank united stock price can offer valuable insights. Ultimately, however, a thorough understanding of BTE’s specific financial health and market position is crucial for informed investment decisions.

FAQ: Bte Stock Price

What are the major risks associated with investing in BTE stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., poor financial performance, legal issues), and macroeconomic factors. BTE stock is subject to these general risks, and specific risks should be researched before investing.

Where can I find real-time BTE stock price data?

Real-time BTE stock price data can typically be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, or Bloomberg.

What is BTE’s current dividend yield (if applicable)?

The current dividend yield for BTE stock (if any) can be found on financial websites that provide detailed company information. Note that dividend yields can change over time.

How does BTE compare to its main competitors in terms of market capitalization?

A comparison of BTE’s market capitalization to its competitors requires researching the market capitalization of each company, which is readily available on financial websites. This will provide a relative size comparison.