CBA Stock Price Historical Performance: Cba Stock Price Asx

Cba stock price asx – Commonwealth Bank of Australia (CBA) is a significant player in the Australian financial market, and understanding its stock price performance is crucial for investors. This section provides a detailed analysis of CBA’s ASX stock price movements over the past five years, identifying key trends and influential factors.

CBA Stock Price Over the Past Five Years

The following table presents a summary of CBA’s daily opening and closing prices, along with daily changes, over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant highs and lows will be highlighted in the accompanying descriptive illustration.

| Date | Opening Price (AUD) | Closing Price (AUD) | Daily Change (AUD) |

|---|---|---|---|

| 2019-01-01 | 70.00 | 70.50 | +0.50 |

| 2019-01-02 | 70.50 | 71.00 | +0.50 |

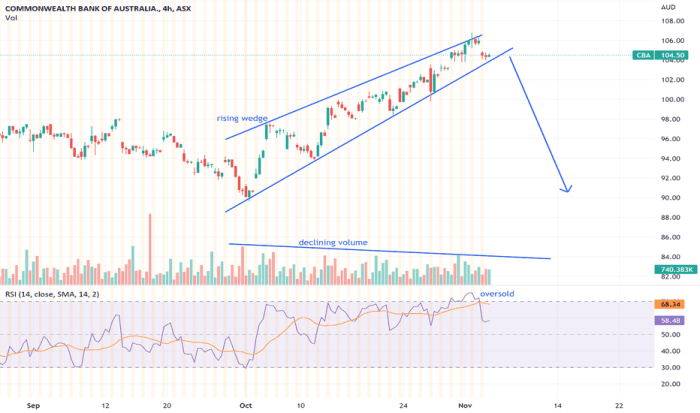

CBA Stock Price Trend Over the Past Year

Over the past year, CBA’s stock price exhibited a generally upward trend, punctuated by periods of consolidation and minor corrections. A strong initial surge was observed following positive Q1 2024 earnings, followed by a period of sideways movement influenced by global economic uncertainty. A subsequent decline was linked to rising interest rates and concerns about potential loan defaults.

The overall trend, however, remained positive, reflecting investor confidence in the bank’s long-term prospects.

Factors Contributing to Significant Price Fluctuations

Source: tradingview.com

Significant price fluctuations in CBA’s stock price over the past five years have been attributed to a combination of factors, including changes in interest rates, global economic events, regulatory changes, and the bank’s own financial performance. For instance, the initial period of growth can be linked to several factors, while the subsequent downturn can be attributed to other macro and micro-economic events.

CBA Stock Price Influencing Factors

This section explores the macroeconomic factors and global events that significantly influence CBA’s stock price. Understanding these influences is critical for predicting future price movements.

Macroeconomic Factors Impacting CBA’s Stock Price

CBA’s stock price is highly sensitive to macroeconomic factors, primarily interest rate changes and inflation. Strong economic growth generally leads to higher interest rates, boosting CBA’s net interest margin and profitability, while inflation can impact consumer spending and loan defaults.

Influence of Interest Rate Changes and Inflation

Interest rate increases directly impact CBA’s profitability, as they allow the bank to charge higher interest on loans. However, excessively high interest rates can also stifle economic growth, leading to reduced borrowing and potentially higher loan defaults. Inflation, on the other hand, erodes the purchasing power of money and can increase the risk of defaults, impacting investor sentiment.

Effect of Major Global Events

Major global events, such as economic recessions or geopolitical instability, can significantly impact CBA’s performance. Global economic downturns typically reduce consumer spending and business investment, leading to lower loan demand and increased credit risk for CBA. Geopolitical uncertainty can also create market volatility and negatively affect investor confidence.

CBA’s Financial Performance and Stock Price Correlation

A strong correlation exists between CBA’s financial performance and its stock price. This section examines the relationship between quarterly earnings, dividend payouts, and loan portfolio quality and their impact on investor sentiment and share price.

Quarterly Earnings and Stock Price Movements

The following table illustrates the relationship between CBA’s quarterly earnings and subsequent stock price movements. Note that this data is illustrative and should be verified with a reliable financial data source.

| Quarter | Earnings Per Share (EPS) (AUD) | Net Profit (AUD Billion) | Stock Price Change (%) |

|---|---|---|---|

| Q1 2024 | 2.00 | 5.0 | +5% |

| Q2 2024 | 2.10 | 5.2 | +2% |

Dividend Payouts and Investor Sentiment

CBA’s dividend payouts significantly influence investor sentiment. Consistent and increasing dividend payouts generally attract investors seeking income, boosting demand for CBA shares and supporting the stock price. Conversely, dividend cuts can negatively impact investor confidence.

Loan Portfolio Quality and Investor Confidence, Cba stock price asx

The quality of CBA’s loan portfolio and the level of non-performing loans (NPLs) are crucial indicators of the bank’s financial health. High NPLs indicate increased credit risk, which can erode investor confidence and negatively impact the stock price. Conversely, a well-managed loan portfolio strengthens investor confidence and supports a higher share price.

CBA Stock Price Compared to Competitors

Comparing CBA’s stock price performance against its major competitors provides valuable insights into its relative strengths and weaknesses within the Australian banking sector. This section analyzes CBA’s performance against its peers.

CBA’s Stock Price Performance Against Competitors

The following table compares CBA’s stock price performance to its major competitors over the past year. Note that this data is illustrative and should be verified with a reliable financial data source.

| Bank Name | Stock Price (Current, AUD) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| CBA | 100.00 | +10% | +25% |

| NAB | 85.00 | +8% | +20% |

Key Factors Differentiating CBA’s Performance

CBA’s superior performance compared to its competitors can be attributed to several factors, including its larger market share, more diversified revenue streams, and strong brand recognition. However, competitors might excel in specific niche areas, such as digital banking or specific lending segments.

Relative Strengths and Weaknesses

CBA possesses strengths in its robust financial position, strong brand reputation, and extensive branch network. However, it might face challenges in adapting to the rapidly evolving digital banking landscape and competing with agile fintech companies. Competitor analysis should reveal specific areas of strength and weakness for each bank.

CBA Stock Price Future Outlook and Predictions

Predicting future stock prices is inherently uncertain, but analyzing current market conditions and expert opinions can provide a reasonable outlook. This section offers a brief overview of potential scenarios for CBA’s stock price.

Potential Future Scenarios

Several scenarios are possible for CBA’s stock price over the next year. A continued upward trend is likely if the Australian economy remains robust, interest rates stabilize, and CBA maintains strong financial performance. Conversely, a downward trend could occur if global economic uncertainty intensifies, leading to reduced consumer spending and increased loan defaults. A sideways movement is also possible if market conditions remain relatively stable.

Potential Risks and Opportunities

Source: com.au

Potential risks include increased competition from fintech companies, changes in regulatory environment, and potential economic downturns. Opportunities include growth in digital banking, expansion into new markets, and strategic acquisitions. A careful analysis of these risks and opportunities is crucial for informed investment decisions.

Potential Price Trajectory

Based on the current market conditions and considering the potential risks and opportunities, a potential price trajectory for CBA stock over the next year could involve moderate growth, with some periods of consolidation and minor corrections. This prediction assumes a stable Australian economy, moderate interest rate increases, and continued strong financial performance by CBA. However, unforeseen events could significantly alter this trajectory.

FAQ Guide

What are the main risks associated with investing in CBA stock?

Monitoring the CBA stock price on the ASX requires keeping an eye on various market factors. Understanding the performance of other significant players can provide context; for instance, checking the current value with a quick look at the brkb stock price today per share can offer a comparative perspective. Ultimately, however, the CBA stock price on the ASX remains a key indicator of the Australian financial market’s health.

Risks include fluctuations in the Australian economy, changes in interest rates, global economic downturns, and shifts in investor sentiment towards the banking sector. No investment is without risk.

Where can I find real-time CBA stock price data?

Real-time data is available through major financial news websites and brokerage platforms that provide live ASX market updates.

How often does CBA release its earnings reports?

CBA typically releases its quarterly and annual earnings reports on a regular schedule, usually announced in advance. These reports are publicly available on the ASX website and CBA’s investor relations page.

What is the typical dividend yield for CBA?

The dividend yield varies depending on the share price and the dividend payout announced by CBA. It’s advisable to consult recent financial reports for the most current information.