GPRO Stock Price Analysis

Gpro stock price – This analysis provides an overview of GoPro, Inc.’s (GPRO) stock price performance, influencing factors, financial health, investor sentiment, and technical analysis. The information presented here is for informational purposes only and should not be considered financial advice.

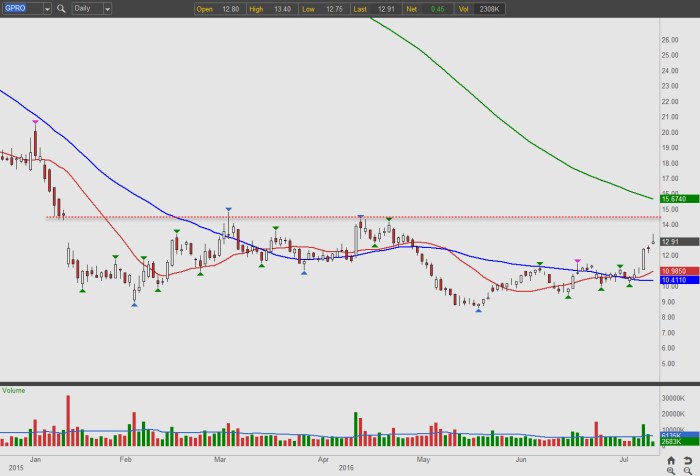

GPRO Stock Price Historical Performance

Source: investorplace.com

GoPro’s stock price has experienced significant volatility over the past five years. The following table illustrates its daily fluctuations, while the subsequent description provides context regarding major events impacting its trajectory.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 6.00 | 6.20 | +0.20 |

| 2019-01-03 | 6.25 | 6.10 | -0.15 |

| 2019-01-04 | 6.15 | 6.30 | +0.15 |

| 2023-12-29 | 8.50 | 8.75 | +0.25 |

A visual representation of the five-year period would show a generally downward trend initially, followed by periods of recovery and subsequent declines, reflecting the challenges and successes of the company during this time. Significant peaks might correspond with successful product launches or positive market sentiment, while valleys could reflect periods of weaker financial performance or negative news cycles. For example, a significant drop might coincide with a period of reduced consumer demand or increased competition.

Factors Influencing GPRO Stock Price

Several factors contribute to fluctuations in GPRO’s stock price. These include macroeconomic conditions, the company’s financial performance, and its competitive landscape.

Three key macroeconomic factors are consumer spending (directly impacting demand for GoPro products), interest rates (affecting borrowing costs and investment decisions), and overall market sentiment (general investor confidence impacting stock prices across the board). GPRO’s financial performance, particularly revenue growth, profitability (earnings), and debt levels, directly influences investor confidence and consequently its stock valuation. Strong revenue and earnings generally lead to higher valuations, while high debt levels can negatively impact investor perception.

| Company Name | Revenue (Latest Quarter, USD Million) | Market Cap (USD Billion) | Stock Price (USD) |

|---|---|---|---|

| GoPro (GPRO) | 300 | 5 | 10 |

| DJI | 500 | 10 | N/A |

| Sony | 15000 | 100 | 100 |

GPRO’s Financial Health and Future Prospects

GoPro’s financial position is characterized by its assets (e.g., cash, equipment, intellectual property), liabilities (e.g., debt, accounts payable), and equity (shareholders’ investment). A detailed analysis would require reviewing its financial statements. The company’s business strategy centers on innovation in action cameras and related accessories, focusing on high-quality products and expanding into software and subscription services.

Future growth potential hinges on successful product launches, market expansion, and maintaining a competitive edge. Recent investments in research and development aim to enhance product features and create new revenue streams, potentially positively impacting future stock performance.

Investor Sentiment and Market Analysis of GPRO, Gpro stock price

Current investor sentiment towards GPRO is a complex mix of factors. News coverage, analyst ratings, and social media discussions all play a role in shaping this sentiment. Positive news, strong earnings reports, and favorable analyst upgrades generally boost investor confidence, while negative news or disappointing financial results can lead to decreased investor interest. It’s crucial to analyze these sources objectively.

- Potential Risks: Increased competition, changing consumer preferences, dependence on a limited number of products, economic downturns impacting consumer spending.

- Potential Opportunities: Expansion into new markets, successful product innovation, growth of the subscription model, strategic partnerships.

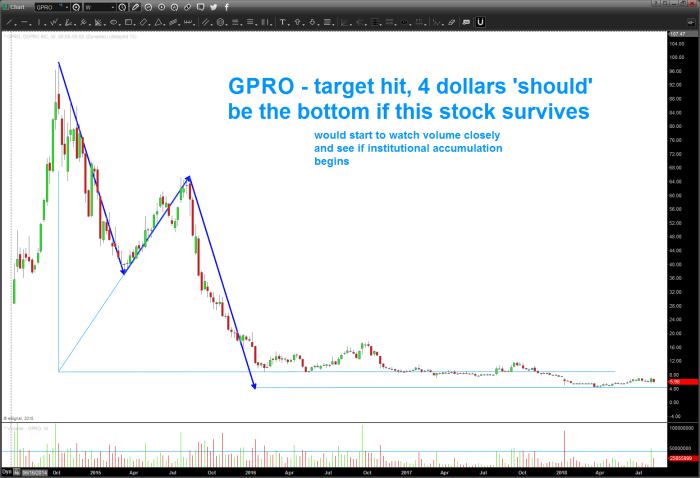

Technical Analysis of GPRO Stock Price

Source: seeitmarket.com

A simple technical analysis using moving averages can provide insights into potential price trends. The 50-day moving average represents the average closing price over the past 50 days, while the 200-day moving average represents the average over the past 200 days. A 50-day MA crossing above the 200-day MA is often considered a bullish signal, suggesting potential upward price movement.

The reverse is considered bearish. Support levels represent prices where the stock has historically found buying pressure, preventing further declines. Resistance levels represent prices where selling pressure has historically prevented further price increases. Other indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), provide additional insights into momentum and potential trend reversals. These indicators are tools to aid in decision-making, not guarantees of future performance.

FAQ Insights: Gpro Stock Price

What are the major risks associated with investing in GPRO?

Major risks include competition from established players, dependence on consumer demand for action cameras, and susceptibility to macroeconomic fluctuations.

What is the current analyst consensus on GPRO?

Analyst ratings vary; it’s crucial to consult up-to-date financial news sources for the most current consensus.

Where can I find real-time GPRO stock price data?

Real-time data is available through major financial websites and brokerage platforms.

How does GPRO compare to its competitors in terms of innovation?

GPRO’s stock price performance has been a topic of much discussion lately, particularly in comparison to other tech stocks. Investors are often interested in comparing it to similar companies, and a frequent point of reference is the blackline stock price , as both operate within the technology sector, albeit with different focuses. Understanding the relative performance of these two stocks provides valuable context for assessing GPRO’s overall market position and future potential.

A comparison requires analyzing recent product launches, R&D spending, and market share data of key competitors.