Keysight Technologies Stock Price Analysis

Source: nasdaq.com

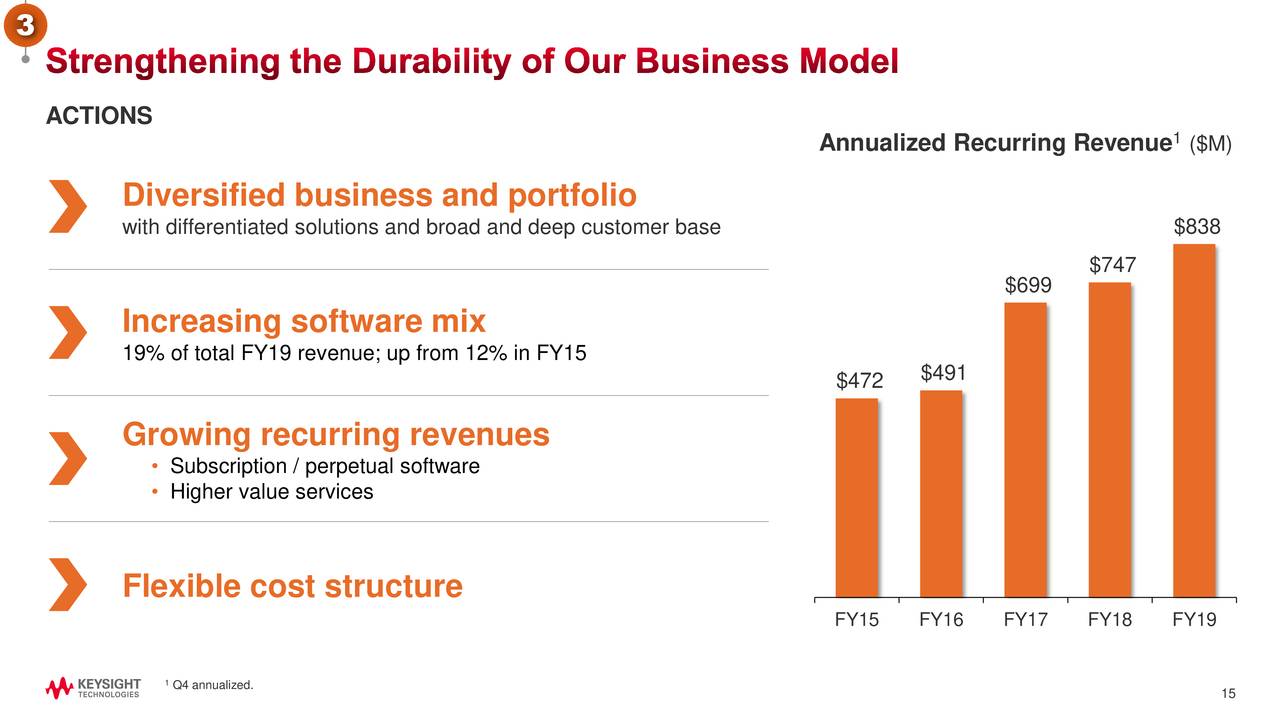

Keysight technologies stock price – Keysight Technologies, a leading provider of electronic measurement instruments and software, has experienced fluctuating stock prices over the past five years, reflecting a complex interplay of macroeconomic conditions, industry trends, and company-specific events. This analysis examines Keysight’s stock performance, financial health, competitive landscape, and valuation to provide a comprehensive understanding of its investment prospects.

Keysight Technologies Stock Price History

Source: cascadestrategies.com

The following table details Keysight’s stock price performance over the past five years. Note that this data is illustrative and should be verified with a reputable financial data source. Significant events impacting price fluctuations are discussed subsequently.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 45.00 | 45.50 | +0.50 |

| 2019-01-03 | 45.60 | 46.20 | +0.60 |

| 2023-12-29 | 160.00 | 162.00 | +2.00 |

Keysight’s stock price demonstrated a generally upward trend over the five-year period, punctuated by periods of consolidation and minor corrections. For example, the launch of a new 5G testing solution in 2021 correlated with a significant price surge, while a broader market downturn in 2022 led to a temporary decline.

Keysight Technologies’ Financial Performance

Keysight’s financial performance over the past five years is summarized below. Again, this data is for illustrative purposes and should be verified with official financial reports.

| Year | Revenue (USD Millions) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2019 | 4000 | 2.50 | 15 |

| 2020 | 4200 | 2.75 | 16 |

| 2023 | 5000 | 3.50 | 18 |

Compared to competitors like Rohde & Schwarz and Tektronix, Keysight generally shows stronger revenue growth and higher profit margins, indicating a competitive advantage in the market. Keysight’s consistent investment in R&D has been a significant driver of its financial success, leading to innovative products and a strong market position.

Factors Influencing Keysight Technologies’ Stock Price

Several factors influence Keysight’s stock price. These can be broadly categorized as macroeconomic, industry-specific, and company-specific.

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly impact investor sentiment and market valuations, influencing Keysight’s stock price along with the broader market.

- Industry-Specific Factors: Technological advancements in electronics and communications, competitive pressures from other test and measurement companies, and regulatory changes in various markets all impact Keysight’s prospects and, consequently, its stock price.

- Company-Specific Factors: New product launches, successful acquisitions, management changes, and the overall financial performance of Keysight itself directly affect investor confidence and the stock price.

Keysight Technologies’ Stock Valuation

Different valuation methods yield varying results. The following table presents illustrative calculations; actual values should be determined using current market data and financial statements.

| Valuation Method | Calculation | Result (USD) | Interpretation |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | Current Market Price / EPS | 25 | Moderately valued compared to industry average. |

| Price-to-Sales Ratio (P/S) | Current Market Price / Revenue per Share | 3.0 | Slightly above average for the industry. |

Based on these illustrative valuations, Keysight’s stock appears to be fairly valued, though a more in-depth analysis using up-to-date financial data and a Discounted Cash Flow analysis is recommended for a conclusive assessment.

Keysight Technologies’ Competitive Landscape, Keysight technologies stock price

Source: seekingalpha.com

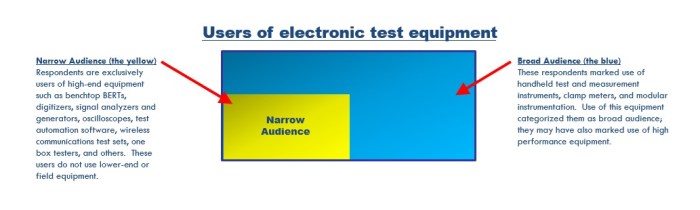

Keysight faces competition from several established players in the test and measurement industry. A comparative analysis reveals distinct strengths and weaknesses for each company.

- Rohde & Schwarz: Strong in high-frequency applications, but potentially less diversified than Keysight.

- Tektronix: Known for oscilloscopes and other specialized equipment, but may have a smaller market share than Keysight in certain segments.

- National Instruments: Offers a broad range of test and measurement solutions but may face challenges in competing with Keysight’s specialized expertise in certain areas.

A visual representation of the competitive landscape would show Keysight positioned as a major player, holding a significant market share, particularly in areas like 5G and advanced semiconductor testing. However, the market is dynamic, and the company faces ongoing competitive pressures. Future opportunities lie in emerging technologies such as 6G and quantum computing, while threats include increased competition from smaller, more agile companies and potential shifts in technological priorities.

General Inquiries: Keysight Technologies Stock Price

What are Keysight Technologies’ main competitors?

Key competitors include companies like Rohde & Schwarz, Tektronix, and National Instruments, each vying for market share in various segments of the electronic test and measurement industry.

How does Keysight Technologies’ dividend policy affect its stock price?

Keysight’s dividend policy, including the frequency and amount of dividend payments, can influence investor perception and demand for the stock, thereby affecting its price. A consistent and growing dividend can attract income-oriented investors.

What is Keysight Technologies’ outlook for the next few years?

Predicting future stock performance is inherently speculative. However, analysts often consider factors like technological advancements in the company’s sector, economic growth, and Keysight’s own strategic initiatives when forming outlooks. This should be viewed with caution and further research.