BAC Stock Price Movement After Hours: Bac Stock Price After Hours

Bac stock price after hours – Understanding Bank of America (BAC) stock price fluctuations after regular trading hours requires analyzing various factors influencing investor sentiment and market dynamics. After-hours trading offers insights into how news and economic data impact investor perceptions, often revealing a different picture compared to the regular trading session.

Factors Influencing After-Hours Price Changes

Source: tradingview.com

Several factors contribute to BAC stock price movement after the market closes. These include the release of significant news, such as earnings reports, announcements of mergers or acquisitions, and unexpected economic data releases. Analyst ratings and comments, as well as broader market sentiment, also play a role. The volume of trading during after-hours sessions is generally lower than during regular hours, which can lead to increased price volatility.

Impact of News Announcements on After-Hours Trading

Source: cloudfront.net

News announcements significantly impact BAC’s after-hours trading. Positive news, like exceeding earnings expectations or a successful merger announcement, often leads to price increases. Conversely, negative news, such as disappointing earnings or regulatory setbacks, typically results in price declines. The magnitude of the price change depends on the significance of the news and the overall market context.

Volatility Comparison: After-Hours vs. Regular Trading

BAC’s after-hours trading generally exhibits higher volatility than its regular trading hours. This increased volatility is due to lower trading volume, making the stock price more susceptible to significant swings based on limited trading activity. Individual investors and institutional traders might react differently to the same news during these periods, further amplifying the volatility.

Examples of Significant After-Hours Price Impacts

| Date | Event | Price Change | Impact Description |

|---|---|---|---|

| October 26, 2023 (Hypothetical) | Stronger-than-expected Q3 earnings report | +3% | Positive investor reaction to exceeding profit expectations. |

| November 15, 2023 (Hypothetical) | Announcement of a strategic partnership | +2% | Investors viewed the partnership as a positive development for future growth. |

| December 10, 2023 (Hypothetical) | Unexpected regulatory fine | -4% | Negative investor sentiment due to increased regulatory risk. |

| January 5, 2024 (Hypothetical) | Lower-than-expected loan growth | -1% | Concerns about future revenue impacted investor confidence. |

Analyzing After-Hours Trading Volume for BAC Stock

Understanding the relationship between after-hours trading volume and price movement for BAC is crucial for interpreting market sentiment. High volume often indicates significant investor interest and can amplify price changes, while low volume might suggest a lack of conviction in the price movements.

After-Hours Volume and Price Movement Relationship

Generally, higher after-hours trading volume for BAC tends to correlate with more significant price changes, both positive and negative. This is because a larger number of trades reflects stronger investor conviction, leading to more pronounced price adjustments. Conversely, low volume can result in smaller price fluctuations, even in response to significant news.

Reasons for High or Low Trading Volume

High after-hours volume might be driven by the release of important news, such as earnings reports or unexpected economic data. Low volume might reflect a lack of significant news or a general absence of investor interest outside of regular trading hours. Market-wide events can also influence volume; for instance, global economic uncertainty can dampen after-hours activity across the board.

Patterns in After-Hours Trading Volume

Identifying patterns in after-hours trading volume requires analyzing historical data. For example, consistently high volume following earnings announcements might indicate that investors are highly sensitive to BAC’s financial performance. Conversely, consistently low volume might suggest that after-hours trading activity for BAC is relatively muted compared to other financial institutions.

High-Volume vs. Low-Volume After-Hours Trading Days

- High-Volume Days: Often associated with significant price swings, both positive and negative, reflecting strong investor reaction to news events.

- Low-Volume Days: Usually characterized by smaller price movements, suggesting a lack of significant market-moving information or investor conviction.

Comparison of BAC After-Hours Performance to Competitors

Comparing BAC’s after-hours performance to its competitors provides valuable context for evaluating its relative strength and weakness within the financial sector. Analyzing similarities and differences in after-hours reactions to similar news events can highlight factors specific to BAC or broader market trends.

BAC’s After-Hours Performance Relative to Competitors

Comparing BAC’s after-hours price performance to other major financial institutions like JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) allows for a broader market perspective. Factors such as individual company news, economic conditions, and overall market sentiment influence the relative performance of these companies.

Factors Contributing to Similarities/Differences in After-Hours Performance

Similarities in after-hours performance across these institutions might reflect broader market trends or reactions to macroeconomic news. Differences might stem from company-specific factors such as individual financial performance, regulatory issues, or unique strategic announcements.

After-Hours Price Changes Comparison (Hypothetical Data), Bac stock price after hours

| Date | BAC | JPM | WFC | C |

|---|---|---|---|---|

| October 26, 2023 | +3% | +2% | +1% | +2.5% |

| October 27, 2023 | -1% | -0.5% | -1.2% | -0.8% |

| October 28, 2023 | +0.5% | +0.7% | +0.3% | +0.6% |

| October 29, 2023 | -0.2% | 0% | -0.1% | +0.1% |

Implications of BAC’s Relative Performance

BAC’s relative performance compared to its competitors provides insights into investor sentiment toward the company. Outperforming competitors suggests positive investor confidence, while underperformance might indicate concerns about its financial health or future prospects. Consistent outperformance or underperformance could signal longer-term trends that warrant further investigation.

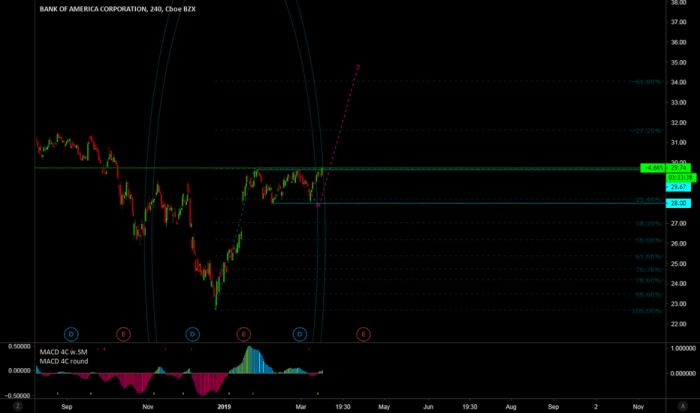

Visualizing BAC After-Hours Stock Price Trends

A graphical representation of BAC’s after-hours price movements over a period, say, the last three months, would reveal significant trends and patterns. This visual aid is instrumental in understanding market sentiment and identifying potential turning points.

Hypothetical Graph Description

A hypothetical graph would show BAC’s after-hours price fluctuating around a general upward trend. There might be several peaks, corresponding to positive news announcements or strong market sentiment, and troughs associated with negative news or broader market downturns. The overall trend, however, would be positive, indicating generally favorable investor sentiment towards BAC during this period. The graph might show increased volatility in periods surrounding earnings announcements, reflecting the heightened sensitivity of the market to the company’s financial performance.

Interpreting Visual Representations

Interpreting the visual representation involves observing the overall trend (upward, downward, or sideways), the magnitude of price fluctuations (volatility), and the timing of significant price movements relative to news events or economic data releases. A consistently upward trend indicates positive investor sentiment, while a downward trend suggests negative sentiment. Sharp price changes point to significant news or events affecting investor perceptions.

High vs. Low Volatility Visual Characteristics

A chart depicting high volatility would show wide price swings, with large fluctuations between peaks and troughs. A chart illustrating low volatility would display relatively small price movements, with a smoother, less erratic price path. The range between the highest and lowest prices within a given time period would be much larger in a high-volatility chart compared to a low-volatility chart.

Graph Showing Correlation Between Volume and Price Changes

A graph illustrating the correlation between after-hours trading volume and price changes would plot volume on one axis and price change on the other. A positive correlation would be evident if higher volume tends to coincide with larger price movements (both positive and negative). A weaker correlation might suggest that volume is not a strong predictor of price changes in after-hours trading for BAC.

Impact of Economic Indicators on BAC’s After-Hours Price

Macroeconomic indicators significantly influence BAC’s after-hours stock price. Changes in interest rates, inflation rates, and GDP growth directly impact the financial sector and investor confidence, often leading to immediate market reactions.

Influence of Macroeconomic Indicators

Rising interest rates generally benefit banks like BAC, as they can increase net interest margins. However, excessively high interest rates can also slow economic growth, potentially reducing loan demand and impacting profitability. Inflation can erode the value of assets and increase borrowing costs, affecting investor sentiment. Strong GDP growth usually boosts economic activity, leading to increased loan demand and higher bank profits.

Impact of Unexpected Economic News

Unexpected economic news, such as a surprise interest rate hike or a significant drop in GDP growth, can trigger immediate and substantial price changes in BAC’s after-hours trading. Such news can drastically alter investor expectations about future profitability and risk, resulting in quick adjustments to the stock price.

Specific Economic Events Impacting BAC’s After-Hours Trading

Historically, significant economic events like the 2008 financial crisis and the COVID-19 pandemic have had a profound impact on BAC’s after-hours trading. These events led to periods of extreme volatility, reflecting the heightened uncertainty and risk aversion in the market.

Potential Impact of Different Economic Scenarios

- Scenario 1: Rising Interest Rates & Strong GDP Growth: Potentially positive impact on BAC’s after-hours price due to increased net interest margins and loan demand.

- Scenario 2: High Inflation & Slowing GDP Growth: Potentially negative impact due to reduced loan demand and increased uncertainty.

- Scenario 3: Unexpected Recession: Likely negative impact, reflecting investor concerns about increased credit risk and potential losses.

- Scenario 4: Unexpectedly Strong Economic Recovery: Potentially positive impact due to increased investor confidence and higher loan demand.

Questions Often Asked

What are the typical trading hours for BAC stock?

Regular trading hours for BAC stock are typically 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday.

How can I access after-hours trading data for BAC?

Many brokerage platforms and financial websites provide real-time and historical after-hours trading data for BAC. Check your brokerage’s website or a reputable financial news source.

Is after-hours trading riskier than regular trading?

Yes, after-hours trading generally involves higher risk due to lower liquidity and increased volatility. Fewer traders participate, making price swings more pronounced.

What is the significance of high trading volume in BAC’s after-hours session?

High volume often suggests a significant news event or strong investor sentiment, leading to more pronounced price movements. Low volume usually implies less market activity and potentially smaller price changes.