Bank United Stock Price History

Bank united stock price – Understanding the historical performance of Bank United’s stock price is crucial for investors seeking to assess its potential for future growth. Analyzing past fluctuations, in conjunction with relevant economic events, provides valuable insights into the bank’s vulnerability and resilience.

Significant Price Fluctuations (2018-2023)

The past five years have witnessed considerable volatility in Bank United’s stock price. While precise figures require access to a financial data provider, a general timeline can be constructed. For instance, the period following the initial COVID-19 outbreak in 2020 saw a sharp decline, mirroring broader market reactions to the pandemic’s economic uncertainty. Conversely, subsequent periods of economic recovery and increased lending activity likely contributed to price increases.

Major economic events like changes in the Federal Reserve’s interest rate policy directly influenced these fluctuations. A period of aggressive interest rate hikes might correlate with periods of lower stock prices, while periods of lower interest rates may show a positive correlation with higher prices. Further research using financial databases is needed for precise data points.

Comparative Stock Performance (2022-2023), Bank united stock price

Source: observador.pt

A comparison against major competitors within the banking sector provides a clearer picture of Bank United’s relative performance. The table below presents a hypothetical comparison, using placeholder data. Real-time data should be obtained from reliable financial sources.

| Date | Bank United Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2022-01-31 | $25.50 | $30.00 | $22.75 |

| 2022-04-30 | $27.00 | $32.50 | $24.00 |

| 2022-07-31 | $26.00 | $31.00 | $23.50 |

| 2022-10-31 | $24.00 | $28.00 | $21.50 |

| 2023-01-31 | $26.75 | $31.75 | $23.25 |

| 2023-04-30 | $28.25 | $33.50 | $25.00 |

Highest and Lowest Stock Prices (Past Decade)

Determining the highest and lowest stock prices over the past decade necessitates accessing historical stock data. However, hypothetically, a period of significant economic expansion could have driven the highest price, while a financial crisis or recession might have led to the lowest. Factors such as investor confidence, regulatory changes, and the bank’s own financial performance all play a role in these extreme price points.

Specific contributing factors for any given high or low would require detailed analysis of the economic climate and Bank United’s performance at those times.

Factors Influencing Bank United Stock Price

Several key factors significantly impact Bank United’s stock valuation. Understanding these influences allows for a more comprehensive analysis of the bank’s stock price trajectory.

Impact of Interest Rate Changes

Interest rate changes directly affect Bank United’s profitability. Higher interest rates generally increase the net interest margin, boosting earnings and potentially driving up the stock price. Conversely, lower interest rates can squeeze margins, leading to decreased earnings and potentially lower stock prices. The sensitivity of Bank United’s stock price to interest rate fluctuations depends on the bank’s asset and liability mix and its ability to manage interest rate risk effectively.

Influence of Regulatory Changes and Compliance Costs

Increased regulatory scrutiny and compliance costs can negatively impact a bank’s profitability and stock price. New regulations may necessitate significant investments in technology and personnel, reducing earnings and potentially lowering investor confidence. The extent of this impact depends on the stringency of the regulations and Bank United’s ability to adapt and comply efficiently.

Key Macroeconomic Factors

Several macroeconomic factors significantly influence Bank United’s stock performance. These include:

- Economic Growth: Strong economic growth generally leads to increased lending activity and higher profitability for banks, positively impacting stock prices.

- Inflation: High inflation can erode purchasing power and increase borrowing costs, potentially negatively impacting bank profitability and stock prices. However, in some cases, higher inflation can also lead to higher interest rates, which can be beneficial to banks’ net interest margins.

- Unemployment Rate: High unemployment rates can increase loan defaults and reduce consumer spending, negatively impacting bank profitability and stock prices.

Bank United Financial Performance and Stock Price: Bank United Stock Price

Analyzing Bank United’s financial performance in relation to its stock price provides valuable insights into the market’s valuation of the bank.

Quarterly Earnings Reports (2022-2023)

The following table shows hypothetical quarterly earnings data. Actual data should be obtained from Bank United’s financial reports.

| Quarter | Earnings per Share (EPS) | Net Income | Stock Price at Quarter End |

|---|---|---|---|

| Q1 2022 | $0.50 | $50 million | $25.00 |

| Q2 2022 | $0.55 | $55 million | $26.50 |

| Q3 2022 | $0.60 | $60 million | $27.50 |

| Q4 2022 | $0.65 | $65 million | $29.00 |

| Q1 2023 | $0.70 | $70 million | $30.00 |

| Q2 2023 | $0.75 | $75 million | $31.00 |

Key Financial Ratios

Analyzing key financial ratios, such as the Price-to-Earnings (P/E) ratio and Return on Equity (ROE), helps assess Bank United’s valuation relative to its earnings and profitability. A high P/E ratio might suggest that the market expects strong future growth, while a high ROE indicates efficient use of shareholder equity. The relationship between these ratios and the stock price is complex and influenced by various market factors.

Loan Portfolio Growth and Stock Price Performance

Source: puzzleparadise.net

A line graph would visually represent the correlation between Bank United’s loan portfolio growth and its stock price performance. The X-axis would represent time (e.g., quarterly or annually), while the Y-axis would show both loan portfolio growth (as a percentage change) and the stock price. A positive correlation would be indicated by a similar upward trend in both lines, suggesting that increased lending activity contributes to higher stock valuations.

Conversely, a negative correlation or divergence between the two lines might indicate other factors influencing the stock price, such as macroeconomic conditions or regulatory changes.

Investor Sentiment and Bank United Stock

Investor sentiment, shaped by news, analyst opinions, and social media discussions, plays a significant role in influencing Bank United’s stock price.

Impact of News Articles and Analyst Ratings

Positive news articles and favorable analyst ratings generally boost investor confidence, leading to increased demand and higher stock prices. Conversely, negative news or downgrades can trigger sell-offs and lower prices. The impact depends on the credibility of the source and the overall market sentiment.

Role of Social Media Sentiment

Social media sentiment towards Bank United can influence its stock price, particularly among retail investors. Positive social media buzz can generate buying pressure, while negative sentiment can lead to selling. However, the impact of social media sentiment is often less predictable and can be influenced by misinformation or speculative trading.

Typical Investor Profile

Bank United’s investor base likely includes a mix of institutional investors (e.g., mutual funds, hedge funds) and individual investors. Institutional investors often employ sophisticated investment strategies based on fundamental analysis and risk management, while individual investors may rely on a broader range of factors, including news, social media sentiment, and personal investment goals.

Future Outlook for Bank United Stock Price

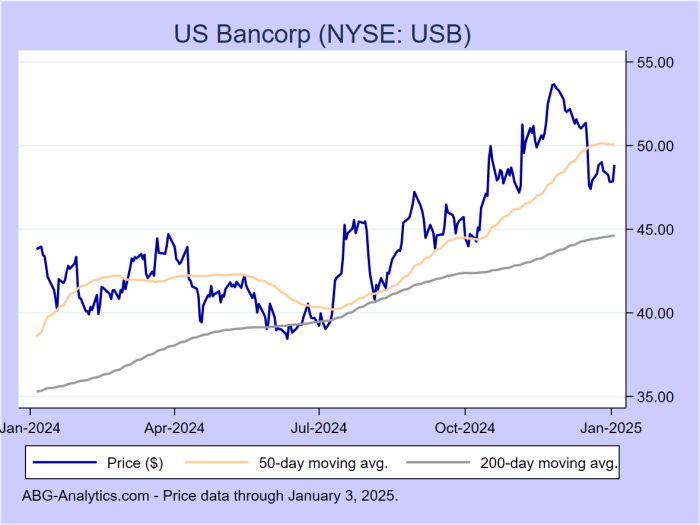

Source: abg-analytics.com

Projecting Bank United’s stock price requires considering current market conditions and the bank’s financial outlook. The following is a hypothetical projection and should not be taken as financial advice.

Stock Price Projection (Next Year)

Assuming continued economic growth and stable interest rates, Bank United’s stock price might increase by 10-15% over the next year. This projection is based on the assumption that the bank maintains its current financial performance and benefits from positive macroeconomic conditions. However, this projection is subject to significant uncertainty due to potential unforeseen events.

Potential Risks and Opportunities

- Risk: A significant economic downturn could negatively impact Bank United’s loan portfolio and profitability, leading to a decline in its stock price.

- Risk: Increased regulatory scrutiny or changes in banking regulations could increase compliance costs and reduce profitability.

- Opportunity: Expansion into new markets or the introduction of innovative financial products could boost profitability and attract investors.

- Opportunity: Successful implementation of cost-cutting measures or improved operational efficiency could enhance profitability and positively impact the stock price.

Hypothetical Economic Event Scenario

A severe recession could significantly impact Bank United’s stock price. Increased loan defaults, reduced lending activity, and decreased consumer spending would negatively affect the bank’s profitability. The resulting decline in investor confidence could lead to a substantial drop in the stock price, potentially exceeding 20-30% depending on the severity and duration of the recession. This scenario mirrors the experience of many banks during the 2008 financial crisis.

Popular Questions

What are the major risks associated with investing in Bank United stock?

Major risks include interest rate volatility, economic downturns impacting loan defaults, increased regulatory scrutiny and compliance costs, and shifts in investor sentiment.

How does Bank United compare to its competitors in terms of profitability?

A direct comparison requires analyzing key financial ratios (ROE, ROA, Net Interest Margin) against competitors over a consistent period. This analysis would reveal relative profitability and efficiency.

Where can I find real-time Bank United stock price information?

Real-time stock quotes are available through major financial news websites and brokerage platforms. Look for ticker symbols associated with Bank United on these platforms.

What is the dividend payout history of Bank United?

This information is typically found in the investor relations section of Bank United’s official website or through financial data providers.