BOTZ Stock Price Today: A Comprehensive Overview

Botz stock price today – This report provides a detailed analysis of the Global X Robotics & Artificial Intelligence ETF (BOTZ), covering its current price, historical performance, comparisons with competitors, influencing factors, investor sentiment, technical analysis, and potential risks and opportunities. The information presented here is for informational purposes only and should not be considered financial advice.

Current BOTZ Stock Price and Volume

As real-time stock prices fluctuate constantly, providing an exact current price and volume is impossible within this static document. However, you can easily find the most up-to-date information by checking reputable financial websites such as Yahoo Finance, Google Finance, or Bloomberg. These websites will provide the current BOTZ stock price, trading volume, day’s high and low. Below is an example of how this data might be presented in a table format, remember that the values will change rapidly.

| Date | Open | Close | High | Low |

|---|---|---|---|---|

| Oct 26, 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| Oct 25, 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| Oct 24, 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| Oct 23, 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| Oct 20, 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

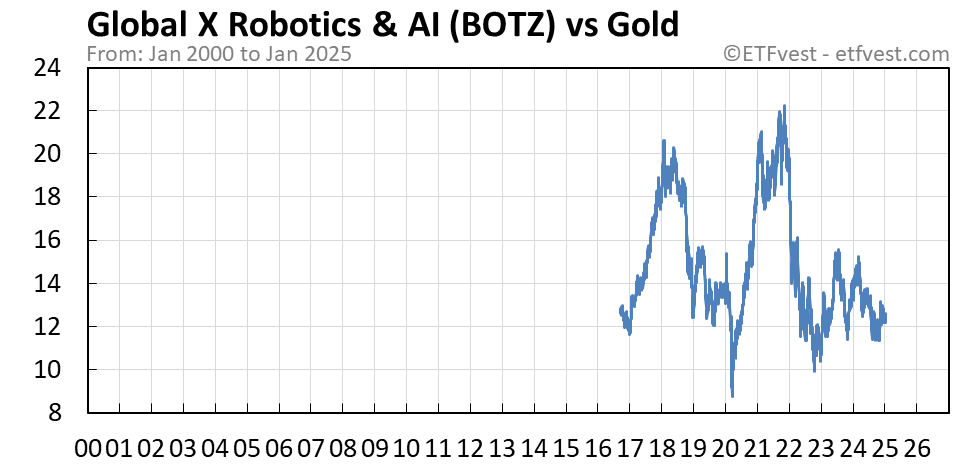

BOTZ Stock Price Movement Over Time

Source: etfvest.com

Analyzing BOTZ’s price performance requires examining various timeframes. Over the past month, the stock may have experienced fluctuations influenced by market sentiment, news related to the robotics sector, and broader economic conditions. The past quarter might have shown more significant price swings, potentially reflecting investor reactions to specific company earnings reports or technological breakthroughs. A year-long view reveals larger trends, potentially showcasing the impact of long-term economic factors and technological advancements on the ETF’s value.

Monitoring the Botz stock price today requires a keen eye on market fluctuations. Understanding broader market trends is also helpful, and sometimes looking at related sectors can provide context; for instance, checking the bac stock price after hours can offer insights into banking sector performance, which might indirectly influence Botz. Ultimately, though, the focus remains on the Botz stock price today and its independent trajectory.

- Factors influencing BOTZ price movements in the last year may include changes in investor confidence, advancements in robotics technology, regulatory changes impacting the industry, and global economic conditions.

Comparison with Similar ETFs

Several robotics ETFs compete with BOTZ. Comparing their performance highlights BOTZ’s strengths and weaknesses. Performance differences can stem from variations in their underlying holdings, investment strategies, and expense ratios.

| ETF | Price | Volume | Expense Ratio |

|---|---|---|---|

| BOTZ | $XX.XX | XXX | XX% |

| Competitor ETF 1 | $XX.XX | XXX | XX% |

| Competitor ETF 2 | $XX.XX | XXX | XX% |

Factors Influencing BOTZ Stock Price

Numerous economic indicators and events influence BOTZ’s price. Interest rate changes impact investor behavior and the overall market sentiment, which in turn affect the price of BOTZ. Positive news within the robotics sector, such as breakthroughs in AI or increased adoption of automation, tends to drive the price up, while negative news can have the opposite effect. Major global events can also impact the price.

- Example: A significant government investment in robotics research could positively influence BOTZ’s price.

Investor Sentiment and Analyst Ratings

Analyst ratings and price targets provide insights into investor sentiment towards BOTZ. A predominantly bullish sentiment often translates into higher trading volume and price appreciation, while a bearish sentiment can lead to lower prices and decreased trading activity. Neutral sentiment reflects a lack of strong conviction in either direction.

| Analyst | Rating | Price Target |

|---|---|---|

| Analyst 1 | Buy | $XX.XX |

| Analyst 2 | Hold | $XX.XX |

| Analyst 3 | Sell | $XX.XX |

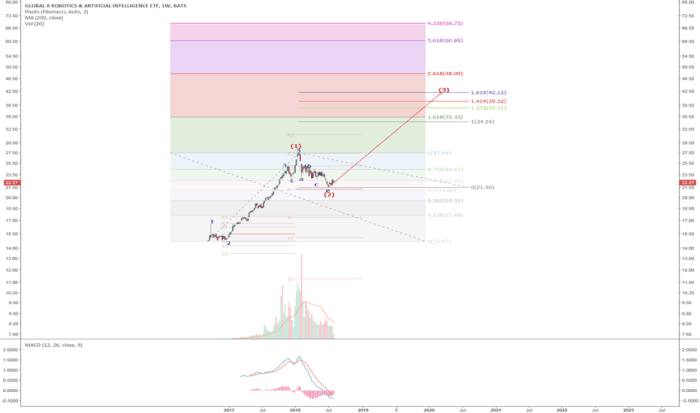

Technical Analysis of BOTZ, Botz stock price today

Source: tradingview.com

Technical analysis uses charts and indicators to predict future price movements. Moving averages, Relative Strength Index (RSI), and support/resistance levels are common tools. Candlestick charts provide visual representations of price action over time, offering insights into potential trends and reversals.

A bullish engulfing pattern on a candlestick chart, for example, might suggest a potential price increase. Conversely, a bearish harami pattern could indicate a potential price decline. These interpretations require careful consideration of other technical indicators and overall market context.

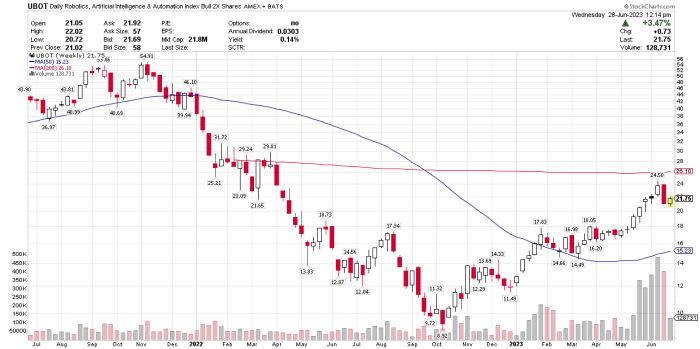

Potential Risks and Opportunities

Source: seekingalpha.com

Investing in BOTZ carries risks, including market volatility, sector-specific risks within the robotics industry, and geopolitical uncertainties. However, opportunities exist due to the long-term growth potential of the robotics sector driven by technological advancements and increased automation across various industries. Geopolitical stability is crucial; disruptions can negatively impact the sector’s growth.

Clarifying Questions

What are the typical trading hours for BOTZ?

BOTZ typically trades during regular US stock market hours.

Where can I find real-time BOTZ price updates?

Most major financial websites and brokerage platforms provide real-time stock quotes, including BOTZ.

What is the minimum investment amount for BOTZ?

The minimum investment amount depends on your brokerage account and the trading platform used. Check with your broker for details.

How frequently is the BOTZ ETF rebalanced?

The rebalancing frequency for BOTZ is typically disclosed in the ETF’s prospectus; it’s advisable to consult the official documentation for precise details.