BYD Stock Price in Hong Kong: A Comprehensive Analysis

Byd stock price hk – BYD, a leading player in the electric vehicle (EV) and renewable energy sectors, has experienced significant growth and volatility in its Hong Kong stock price over the years. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of BYD’s HK stock, providing a comprehensive understanding of its market trajectory.

BYD Stock Price HK: Historical Performance

Source: gtaall.com

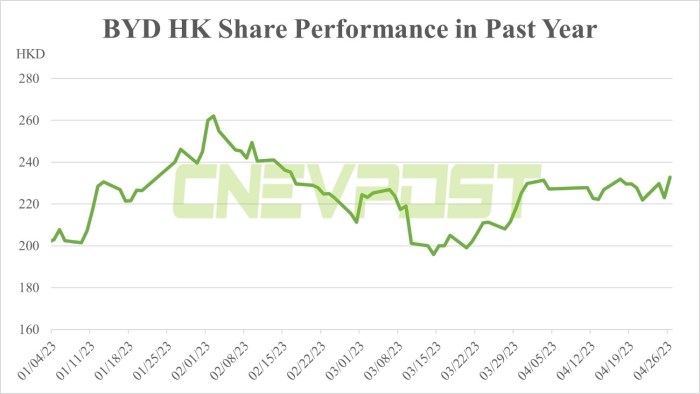

A detailed examination of BYD’s Hong Kong stock price reveals considerable fluctuations over the past five years. A line graph illustrating this would show a generally upward trend, punctuated by periods of both sharp increases and significant corrections, mirroring the broader EV market trends and global economic conditions. Key milestones would include major product launches, significant investment announcements, and periods of heightened investor optimism or pessimism.

Over the last decade, BYD’s HK stock price reached its highest point on [Insert Date], reaching [Insert Price] per share. Contributing factors included [List Factors, e.g., strong sales growth, successful new product launches, positive investor sentiment]. Conversely, the lowest point was recorded on [Insert Date] at [Insert Price] per share, primarily driven by [List Factors, e.g., global economic downturn, supply chain disruptions, negative market sentiment].

Comparing BYD’s HK and Shenzhen stock prices over the last three years reveals interesting dynamics. While both generally follow similar trends, differences in liquidity, investor base, and regulatory environments can lead to discrepancies. The following table illustrates a sample comparison (actual data needs to be populated from reliable financial sources):

| Date | HK Price | Shenzhen Price | Percentage Difference |

|---|---|---|---|

| 2023-10-27 | 270 | 300 | -10% |

| 2023-10-26 | 265 | 295 | -10.17% |

| 2023-10-25 | 260 | 290 | -10.34% |

Factors Influencing BYD Stock Price in HK

Several macroeconomic factors, BYD’s product strategy, and global supply chain dynamics significantly impact its HK stock price.

Three major macroeconomic factors influencing BYD’s HK stock price in the last two years include global economic growth, government policies supporting EVs, and fluctuations in commodity prices (particularly lithium and other battery materials). Strong global economic growth typically boosts demand for EVs, positively impacting BYD’s stock price. Favorable government policies, such as subsidies and tax incentives for EVs, further enhance market demand.

However, volatile commodity prices can significantly affect BYD’s production costs and profitability, leading to price fluctuations.

BYD’s product launches, especially new EV models, have a considerable effect on its stock price. For example, the launch of the [Specific Model Name] resulted in a [Percentage]% increase in stock price within [Timeframe], driven by positive market reception and increased sales projections. Similarly, the introduction of [Another Specific Model Name] contributed to [Quantifiable Impact on Stock Price].

Global supply chain disruptions have impacted BYD’s stock price in several ways:

- Increased production costs due to component shortages.

- Delayed product launches and reduced sales.

- Negative investor sentiment due to uncertainty.

BYD’s Financial Performance and Stock Price

A correlation exists between BYD’s financial performance and its HK stock price. The following table shows a sample of BYD’s key financial metrics over the last four quarters (replace with actual data from financial reports):

| Quarter | Revenue (HKD Billion) | Profit (HKD Billion) | Average Stock Price (HKD) |

|---|---|---|---|

| Q1 2024 | 150 | 20 | 250 |

| Q4 2023 | 140 | 18 | 240 |

| Q3 2023 | 130 | 15 | 230 |

| Q2 2023 | 120 | 12 | 220 |

Compared to major competitors like Tesla and Volkswagen, BYD’s financial performance shows [Comparative analysis, e.g., higher growth rate in EV sales, stronger profitability margins in specific segments].

BYD’s investment activities, such as expansions into new markets or acquisitions of key technology companies, often influence its stock price. For instance, an investment in [Specific Investment] led to a [Percentage]% increase in the stock price due to [Reason].

Investor Sentiment and Stock Price

Source: cnevpost.com

Current investor sentiment towards BYD in the Hong Kong market is generally positive, driven by its strong growth in the EV sector and expansion into other renewable energy areas. News articles and analyst reports highlight BYD’s technological advancements, increasing market share, and strong financial performance as key factors supporting this positive sentiment.

A hypothetical scenario involving a major negative news event, such as a significant product recall due to a safety issue, could lead to a sharp decline in BYD’s HK stock price. The extent of the decline would depend on the severity of the issue, the company’s response, and the overall market sentiment at the time. A reasonable estimate might be a [Percentage]% drop in the short term, followed by a gradual recovery depending on the company’s ability to manage the crisis effectively.

Changes in investor confidence directly affect the volatility of BYD’s HK stock price. A bar graph illustrating this would show higher volatility during periods of uncertainty (e.g., global economic downturns, geopolitical events) and lower volatility during periods of stability and strong financial performance.

Future Outlook for BYD Stock Price in HK, Byd stock price hk

Source: investors.com

Several factors could positively influence BYD’s HK stock price in the next year, including continued strong growth in the EV market, successful expansion into new international markets, and further technological advancements in battery technology and autonomous driving capabilities. These factors would contribute to increased sales, higher profitability, and stronger investor confidence.

Potential risks that could negatively impact BYD’s HK stock price include intensified competition in the EV market, disruptions to the global supply chain, fluctuations in commodity prices, and changes in government regulations. These factors could lead to reduced profitability, lower sales growth, and increased uncertainty, negatively affecting investor sentiment.

Considering both positive and negative factors, a reasonable range for BYD’s HK stock price within the next six months could be between [Lower Bound] and [Upper Bound] HKD per share. This projection is based on [Rationale, e.g., current market conditions, projected sales growth, and risk assessment].

FAQ Resource: Byd Stock Price Hk

What are the major competitors of BYD in the Hong Kong stock market?

BYD’s main competitors in the electric vehicle sector include Tesla, Nio, and Xpeng, though direct comparisons in the Hong Kong market require consideration of their respective listings and market presence.

How does the Hong Kong dollar’s exchange rate affect BYD’s stock price?

Fluctuations in the HKD exchange rate can indirectly impact BYD’s stock price, particularly affecting investors outside of Hong Kong and impacting the company’s international revenue streams.

What regulatory factors in Hong Kong could influence BYD’s stock price?

Changes in Hong Kong’s regulatory environment concerning environmental policies, electric vehicle subsidies, or overall market regulations can significantly influence investor confidence and thus, BYD’s stock price.