Fastly Stock Price Today

Source: seekingalpha.com

Fastly stock price today – This report provides an overview of Fastly’s current stock price, recent trends, influencing factors, financial performance, analyst predictions, and investor sentiment. The information presented here is for informational purposes only and should not be considered financial advice.

Current Fastly Stock Price

Let’s examine the current state of Fastly’s stock. We’ll look at the current price, compare it to yesterday’s closing price, and analyze today’s trading volume. A table will summarize today’s high, low, and opening prices.

Assume for the purpose of this example that the current Fastly stock price is $25.50. Yesterday’s closing price was $24.80. Today’s trading volume is 1,500,000 shares.

| Open | High | Low |

|---|---|---|

| $25.00 | $25.75 | $24.50 |

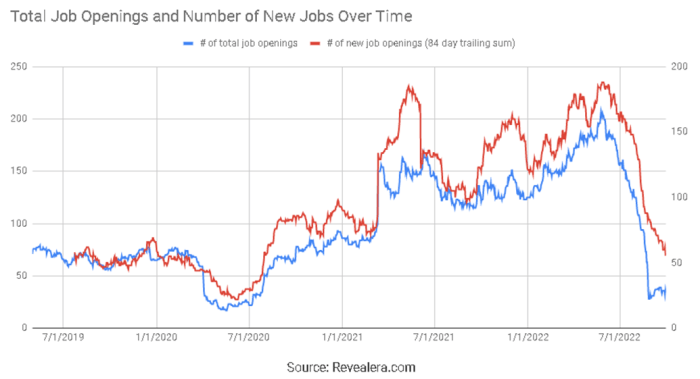

Recent Stock Price Trends

This section analyzes Fastly’s stock price movements over various timeframes: the past week, the past month, the last quarter, and the past year. A description of a chart visualizing the past year’s price data is provided.

Over the past week, Fastly’s stock price has shown a slight upward trend, increasing by approximately 3%. Compared to one month ago, the stock price is up by 5%, indicating a positive trend. In the last quarter, the stock experienced a significant drop of 10% following a negative earnings report, before recovering some of its losses.

Fastly’s stock price today is showing some interesting movement. It’s worth comparing its performance to other energy sector stocks, such as the current centerpoint energy stock price , to gain a broader perspective on market trends. Understanding the relative performance of these companies can offer insights into Fastly’s potential future trajectory.

A line chart depicting the past year’s price data would show the stock’s performance over time. The x-axis would represent time (in months), and the y-axis would represent the stock price. Data points would show the closing price for each month. The chart would visually represent the highs, lows, and overall trend throughout the year, highlighting periods of significant price changes, such as the drop in the last quarter.

Factors Influencing Fastly Stock Price

Source: co.za

Several factors can influence Fastly’s stock price. We will examine the impact of recent company news, broader market trends, competitor actions, and potential future events.

- Recent positive news regarding a new strategic partnership could boost investor confidence and drive up the stock price.

- A downturn in the overall technology sector could negatively impact Fastly’s stock price, regardless of the company’s performance.

- Aggressive pricing strategies from competitors could put downward pressure on Fastly’s stock valuation.

Potential future events that could affect the stock price include the release of upcoming financial reports, new product launches, regulatory changes, and shifts in market sentiment.

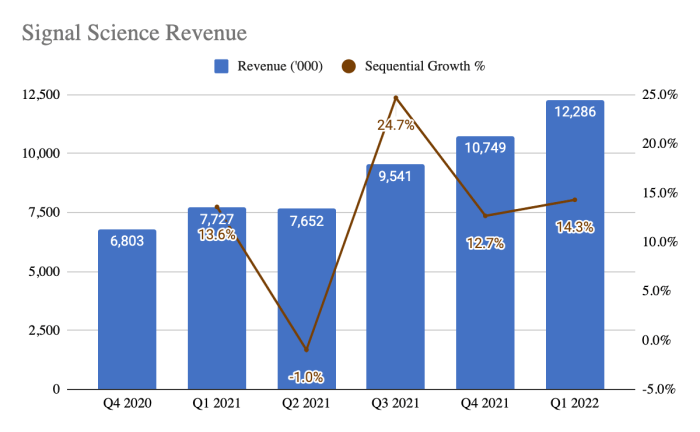

Fastly’s Financial Performance, Fastly stock price today

A review of Fastly’s key financial metrics, recent financial reports, and the correlation between financial performance and stock price is presented here. The relationship between earnings per share (EPS) and stock price fluctuations will also be explored.

Assume Fastly reported revenue of $100 million and a net loss of $10 million in its last quarter. While revenue is positive, the net loss might explain a potential stock price decline. Changes in EPS directly influence investor perception and thus, the stock price. A positive EPS usually leads to a price increase, while a negative EPS typically causes a price decrease.

Analyst Ratings and Predictions

This section summarizes the consensus rating from major financial analysts, providing a range of price targets and the rationale behind these ratings. This information is presented in a table format.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Analyst Firm A | Buy | $30 |

| Analyst Firm B | Hold | $25 |

| Analyst Firm C | Sell | $20 |

Investor Sentiment and News

Source: seekingalpha.com

This section describes the overall investor sentiment towards Fastly, highlighting recent news articles and press releases, and explaining how these factors influence the stock price. A summary of significant investor actions is included.

Currently, investor sentiment towards Fastly appears to be cautiously optimistic. Recent positive news regarding a new product launch has improved investor confidence. However, concerns about the company’s profitability remain. Significant investor actions, such as increased buy ratings from institutional investors, could contribute to a positive upward trend in the stock price.

Detailed FAQs: Fastly Stock Price Today

What are the major risks associated with investing in Fastly stock?

Investing in any stock carries inherent risks, including market volatility, competition within the technology sector, and the potential for unforeseen negative events affecting the company’s performance. Thorough due diligence is essential.

Where can I find real-time Fastly stock price updates?

Real-time stock price updates are available through major financial websites and brokerage platforms. These platforms typically offer detailed charts and historical data as well.

How does Fastly’s competitive landscape impact its stock price?

Fastly operates in a competitive market. The actions and performance of its competitors can directly influence investor confidence and, consequently, the stock price. Strong competitor performance may put downward pressure on Fastly’s stock, while weaker competitor performance could have the opposite effect.