Fuel Cell Energy Stock Market Overview

Fuel cell energy stock price – The fuel cell energy sector, while still nascent compared to established renewable energy sources like solar and wind, has shown periods of significant growth and volatility in its stock market performance. Understanding the historical trends, influencing factors, and comparative performance against other renewable energy sectors is crucial for investors considering this market.

Historical Overview of Fuel Cell Energy Stock Performance

Fuel cell energy stocks have experienced a rollercoaster ride over the past two decades. Early enthusiasm, fueled by technological advancements and environmental concerns, led to periods of rapid price appreciation. However, challenges in scaling production, high initial costs, and the fluctuating availability of government subsidies have resulted in significant price corrections. More recently, increased focus on decarbonization and the development of hydrogen infrastructure have spurred renewed investor interest.

Major Factors Influencing Fuel Cell Energy Stock Prices

Several key factors significantly influence the price fluctuations of fuel cell energy stocks. These include technological breakthroughs (e.g., increased efficiency and durability), government policies (subsidies, tax credits, and environmental regulations), the overall market sentiment towards renewable energy, and the progress in hydrogen infrastructure development. Furthermore, the financial performance of individual companies, including revenue growth, profitability, and debt levels, plays a crucial role.

Comparison with Other Renewable Energy Sectors

Compared to established renewable energy sectors like solar and wind, fuel cell energy stocks have generally exhibited higher volatility. Solar and wind energy have benefited from economies of scale and substantial government support, leading to more stable, albeit slower, growth. However, fuel cell technology offers unique advantages in certain applications, such as stationary power generation and transportation, potentially leading to higher growth in the long term, albeit with increased risk.

Top 5 Fuel Cell Energy Companies

The following table presents a snapshot of the top five fuel cell energy companies by market capitalization (Note: Market capitalization fluctuates constantly and data should be verified with current financial sources).

| Company | Market Capitalization (USD Billions – Example Data) | Country | Key Focus |

|---|---|---|---|

| Company A | 15 | USA | Stationary Power |

| Company B | 12 | Germany | Transportation |

| Company C | 8 | Japan | Fuel Cell Systems |

| Company D | 6 | Canada | Hydrogen Production |

| Company E | 5 | South Korea | Industrial Applications |

Company-Specific Analysis of Fuel Cell Energy Stocks

A deeper dive into individual companies reveals diverse business models, financial performance, and technological advancements that shape their stock valuations. Analyzing these factors allows investors to make more informed decisions.

Business Models of Major Fuel Cell Companies

Source: seekingalpha.com

Three major fuel cell companies demonstrate different approaches to market penetration. Company A focuses on large-scale stationary power generation for utilities and industrial clients. Company B prioritizes the development of fuel cell systems for transportation, particularly heavy-duty vehicles. Company C emphasizes a broader approach, supplying fuel cell systems to various sectors including transportation, industrial applications, and residential use. These diverse strategies reflect the varied applications of fuel cell technology.

Financial Performance Comparison

Comparing the financial performance of two leading companies, such as Company A and Company B, reveals interesting contrasts. Company A, with its focus on stationary power, might demonstrate more stable revenue streams but potentially lower growth rates compared to Company B, which may experience higher volatility due to the more dynamic nature of the transportation sector. Analyzing revenue, profit margins, and debt levels provides valuable insights into the financial health and future prospects of each company.

Key Technological Advancements and Stock Prices

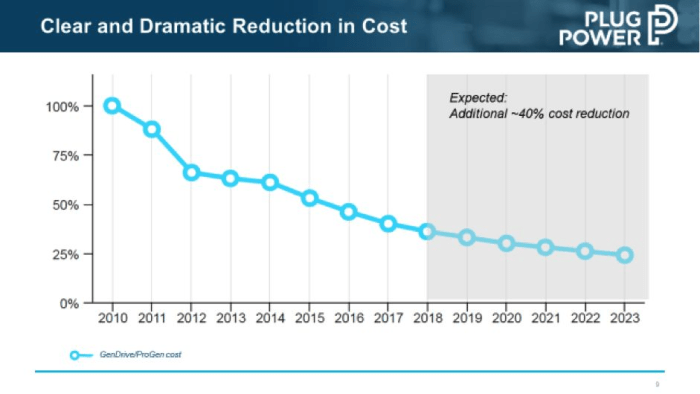

Significant technological advancements, such as improvements in fuel cell durability, efficiency, and cost reduction, directly impact the stock prices of fuel cell companies. For instance, the development of a more durable and cost-effective membrane electrode assembly (MEA) can significantly enhance the competitiveness of a company’s products, leading to increased market share and higher stock valuation.

Risks and Opportunities of Investing in Company A

- Opportunities: Strong market position in stationary power, potential for significant growth in the renewable energy sector, government support for decarbonization initiatives.

- Risks: High initial investment costs, competition from other renewable energy technologies, dependence on government policies and subsidies, technological risks associated with fuel cell durability and efficiency.

Impact of Government Policies and Regulations: Fuel Cell Energy Stock Price

Government policies play a pivotal role in shaping the fuel cell energy sector and influencing the stock prices of companies within it. Subsidies, tax incentives, and environmental regulations can significantly impact the growth and profitability of fuel cell businesses.

Influence of Government Subsidies and Tax Incentives

Government subsidies and tax incentives are crucial in accelerating the adoption of fuel cell technology. These incentives reduce the initial cost of fuel cell systems, making them more competitive with traditional energy sources. Changes in government policies, including the reduction or elimination of subsidies, can negatively impact stock prices.

Effects of Environmental Regulations

Stringent environmental regulations, aimed at reducing greenhouse gas emissions, create a favorable environment for fuel cell technology. Regulations that limit the use of fossil fuels can drive demand for cleaner energy solutions, boosting the growth and stock valuations of fuel cell companies.

Impact of International Trade Policies

International trade policies, including tariffs and trade agreements, can influence the competitiveness of fuel cell companies in the global market. Tariffs on imported fuel cell components can increase production costs, while favorable trade agreements can expand market access and boost stock prices.

Impact of Key Policies in Different Countries, Fuel cell energy stock price

| Country | Policy Type | Impact on Fuel Cell Stocks | Example |

|---|---|---|---|

| USA | Tax Credits | Positive | Investment Tax Credit for clean energy technologies |

| Germany | Renewable Energy Targets | Positive | Ambitious targets for renewable energy integration |

| Japan | Government Funding for R&D | Positive | Significant investments in fuel cell technology development |

| China | Environmental Regulations | Positive (long-term) | Stricter emission standards for vehicles and industrial plants |

Technological Advancements and Future Outlook

Continuous technological advancements are crucial for the long-term success of the fuel cell energy sector. Breakthroughs in fuel cell technology, along with the development of supporting infrastructure, will significantly shape the future outlook and stock valuations of fuel cell companies.

Latest Technological Breakthroughs

Recent breakthroughs include advancements in materials science leading to more durable and efficient fuel cells, improvements in catalyst technology enhancing performance, and the development of cost-effective manufacturing processes. These advancements are steadily reducing the cost and improving the performance of fuel cell systems, making them more competitive in the energy market.

Future Growth Projections

Projections for the future growth of the fuel cell energy market vary, depending on factors such as technological advancements, government policies, and the development of hydrogen infrastructure. However, many analysts anticipate significant growth in the coming decades, driven by increasing demand for clean energy and the need to decarbonize various sectors. This anticipated growth is likely to translate into higher stock valuations for fuel cell companies.

Challenges and Opportunities in Different Application Areas

Source: capital.com

Fuel cell technology faces unique challenges and opportunities in different application areas. In transportation, the need for improved energy density and cost reduction remains crucial. In stationary power, the focus is on large-scale deployment and integration with existing power grids. The development of robust and reliable fuel cell systems is essential across all application areas.

Impact of Hydrogen Infrastructure Development

The development of a robust hydrogen infrastructure, including production, storage, and distribution networks, is critical for the widespread adoption of fuel cell technology. Investments in hydrogen infrastructure will significantly reduce the cost and improve the convenience of using fuel cell systems, leading to increased demand and higher stock valuations for fuel cell companies.

Investment Strategies and Risk Assessment

Investing in fuel cell energy stocks requires a thorough understanding of various investment strategies and a careful assessment of the associated risks. A well-informed approach, considering both the potential rewards and risks, is crucial for successful investment in this sector.

Investment Strategies for Fuel Cell Energy Stocks

Investors can employ various strategies, such as long-term holding for capital appreciation, short-term trading based on market fluctuations, or a combination of both. Long-term investors benefit from the potential for significant growth in the fuel cell energy sector, while short-term traders focus on capturing price movements based on news and market sentiment. Diversification across multiple companies is crucial to mitigate risk.

Key Risks Associated with Investing in Fuel Cell Energy Stocks

Investing in fuel cell energy stocks carries inherent risks. Technological risk involves the possibility of unforeseen technical challenges delaying the commercialization of fuel cell technology. Market risk encompasses the volatility of stock prices due to overall market conditions and investor sentiment. Regulatory risk stems from changes in government policies and regulations that could impact the profitability of fuel cell companies.

Risk-Reward Profile

The risk-reward profile of fuel cell energy stocks can be characterized as moderately high risk, with the potential for high reward. While the sector offers significant long-term growth potential, investors must be prepared for short-term price volatility and the possibility of losses. The risk-reward balance depends on factors such as the chosen investment strategy, the selection of specific companies, and the investor’s risk tolerance.

Importance of Diversification

Diversification is crucial in mitigating the risks associated with investing in fuel cell energy stocks. Investing in multiple companies with diverse business models and technological approaches reduces dependence on any single company’s performance. A diversified portfolio can help cushion the impact of potential setbacks and enhance the overall return on investment.

The volatility in fuel cell energy stock prices often reflects broader market trends. For instance, understanding the performance of established energy giants like Chevron can offer insight; checking the current chevron price stock might reveal correlations. Ultimately, though, fuel cell energy’s future hinges on technological advancements and government policies more than the price of traditional oil.

Clarifying Questions

What are the main risks associated with investing in fuel cell energy stocks?

Key risks include technological uncertainty (failure to meet performance targets), market volatility (subject to investor sentiment shifts), regulatory changes (affecting subsidies and incentives), and competition (from other renewable energy sources).

How can I diversify my fuel cell energy stock portfolio?

Diversification involves investing in a range of fuel cell companies, geographically diverse projects, and potentially other renewable energy sectors to mitigate risk associated with any single company or technology.

What is the projected growth of the fuel cell energy market?

Growth projections vary, but many analysts predict significant expansion over the next decade, driven by increasing demand for clean energy and supportive government policies. However, these are projections and actual growth may differ.

Are there any ethical considerations when investing in fuel cell energy stocks?

Ethical considerations include scrutinizing companies’ environmental and social impact, including their sourcing of materials and labor practices. Investors should research a company’s ESG (environmental, social, and governance) performance before investing.