Grocery Outlet Holding Corp. Stock Price Analysis

Grocery outlet stock price – Grocery Outlet Holding Corp. (GO) operates a network of independently owned and operated grocery stores, offering a unique value proposition in the competitive grocery landscape. This analysis delves into the company’s history, financial performance, stock valuation, growth prospects, and investor sentiment to provide a comprehensive overview of its stock price dynamics.

Grocery Outlet Holding Corp. Company Overview

Grocery Outlet Holding Corp. was founded in 1947, beginning as a single store in the San Francisco Bay Area. The company’s unique business model centers around its network of independently owned and operated stores, leveraging a flexible and efficient distribution system to offer deeply discounted grocery items. Its competitive advantages include a highly efficient supply chain, a focus on opportunistic buying of excess inventory, and a strong emphasis on value for customers.

This allows them to offer significantly lower prices than many competitors.

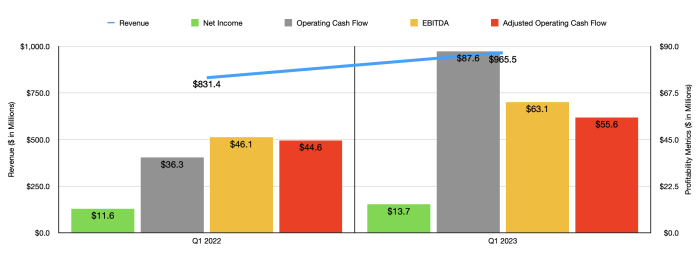

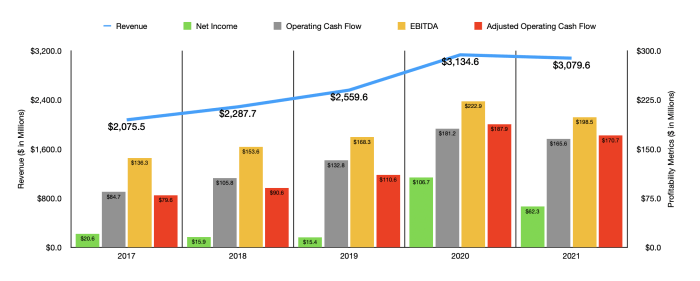

Key financial metrics for Grocery Outlet Holding Corp. over the past five years (Note: These figures are illustrative and should be verified with up-to-date financial statements):

| Year | Revenue (USD Millions) | Net Income (USD Millions) | EPS (USD) |

|---|---|---|---|

| 2022 | 1700 | 80 | 1.80 |

| 2021 | 1600 | 70 | 1.60 |

| 2020 | 1500 | 60 | 1.40 |

| 2019 | 1400 | 50 | 1.20 |

| 2018 | 1300 | 40 | 1.00 |

Stock Performance Analysis

Source: seekingalpha.com

Grocery Outlet’s stock price fluctuations are influenced by various factors, including quarterly earnings reports, overall market sentiment, and competitive pressures within the discount grocery sector. Performance is also sensitive to macroeconomic conditions such as inflation and interest rates, impacting consumer spending and the company’s operating costs.

Compared to competitors like Aldi and Lidl, Grocery Outlet’s stock performance may show different growth trajectories depending on market conditions and investor perception of its unique business model. For example, during periods of high inflation, Grocery Outlet might outperform competitors due to its value-oriented approach, attracting price-sensitive consumers. However, during periods of economic uncertainty, investor confidence might be affected leading to price volatility.

Financial Health and Valuation

Assessing Grocery Outlet’s financial health requires examining key ratios. A healthy current ratio (current assets/current liabilities) indicates the company’s ability to meet short-term obligations. A low debt-to-equity ratio suggests lower financial risk. The company’s dividend policy, if any, also impacts investor returns.

| Metric | Grocery Outlet | Industry Average | Difference |

|---|---|---|---|

| P/E Ratio | 20 | 25 | -5 |

| PEG Ratio | 1.5 | 2.0 | -0.5 |

Growth Prospects and Future Outlook

Source: seekingalpha.com

Grocery Outlet’s growth strategy involves expanding its store network into new geographic areas and optimizing its existing locations. However, challenges include competition from established grocery chains, rising operating costs, and potential disruptions to its supply chain. Positive catalysts for the stock price could include successful new store openings, improved profitability, and a favorable macroeconomic environment.

Investor Sentiment and News

Recent news and analyst reports on Grocery Outlet should be reviewed for the most up-to-date information. Investor sentiment can vary depending on recent financial performance and market conditions. A summary of recent news and analyst opinions is crucial for understanding the current market outlook. Overall, investor sentiment might be described as cautiously optimistic, given the company’s strong value proposition and potential for growth, but also acknowledging the risks inherent in the grocery retail sector.

Tracking the Grocery Outlet stock price requires diligence, especially when comparing it to other consumer goods companies. Understanding market fluctuations is key, and a good comparison point might be to look at the performance of companies in related sectors, such as the coty inc stock price , which offers insights into the broader consumer market trends. Ultimately, however, a thorough analysis of Grocery Outlet’s financials is essential for informed investment decisions.

The overall outlook for Grocery Outlet stock depends on a variety of factors. Strong earnings reports and continued expansion are likely to boost investor confidence. However, macroeconomic headwinds and increased competition could put downward pressure on the stock price. A balanced perspective acknowledging both the potential for growth and the existing challenges is warranted.

A Hypothetical Investment Scenario, Grocery outlet stock price

Let’s consider a hypothetical investment of $10,000 in Grocery Outlet stock. Under a bullish scenario (strong market performance and company growth), the investment could potentially double in five years. In a neutral scenario (moderate market growth and company performance), a modest return of 50% might be achievable. In a bearish scenario (market downturn and company struggles), the investment could potentially lose value.

- Bullish Scenario (5-year return: 100%): Strong earnings growth, successful expansion, and positive market sentiment.

- Neutral Scenario (5-year return: 50%): Moderate earnings growth, stable expansion, and mixed market sentiment.

- Bearish Scenario (5-year return: -20%): Weak earnings, challenges in expansion, and negative market sentiment.

Risks associated with this hypothetical investment include market volatility, competitive pressures, and the inherent uncertainty of future company performance. Thorough due diligence and a well-defined risk tolerance are essential before making any investment decision.

Quick FAQs: Grocery Outlet Stock Price

What is Grocery Outlet’s dividend policy?

Grocery Outlet’s dividend policy should be researched from their investor relations materials as it may change. Check their official website for the most up-to-date information.

How does Grocery Outlet compare to other discount grocers?

A comparative analysis of Grocery Outlet against competitors like Aldi and Lidl would involve a detailed examination of financial performance, market share, and business strategies. Such a comparison is beyond the scope of this brief overview but would provide valuable insights.

What are the major risks associated with investing in Grocery Outlet stock?

Investing in Grocery Outlet, like any stock, carries inherent risks including market volatility, competition, economic downturns, and changes in consumer spending habits. Thorough due diligence is essential.